What a Scale AI Rival’s Extraordinary Success Reveals About the Meta Deal

In an increasingly competitive AI landscape, Meta’s recent multi-billion-dollar investment in Scale AI has raised both eyebrows and questions. But a deeper look into one of Scale AI’s rising rivals—reportedly gaining momentum in the shadow of this headline-making deal—offers a critical perspective on what the Meta-Scale agreement really signals about the future of artificial intelligence, data, and platform control.

Scale AI’s Transformation—and Meta’s Motivation

Scale AI has evolved rapidly from a data-labeling startup into one of the most critical infrastructure providers in the AI space. It services some of the most advanced model creators in the world by providing high-quality annotated data, model evaluation tools, and, more recently, support for defense applications.

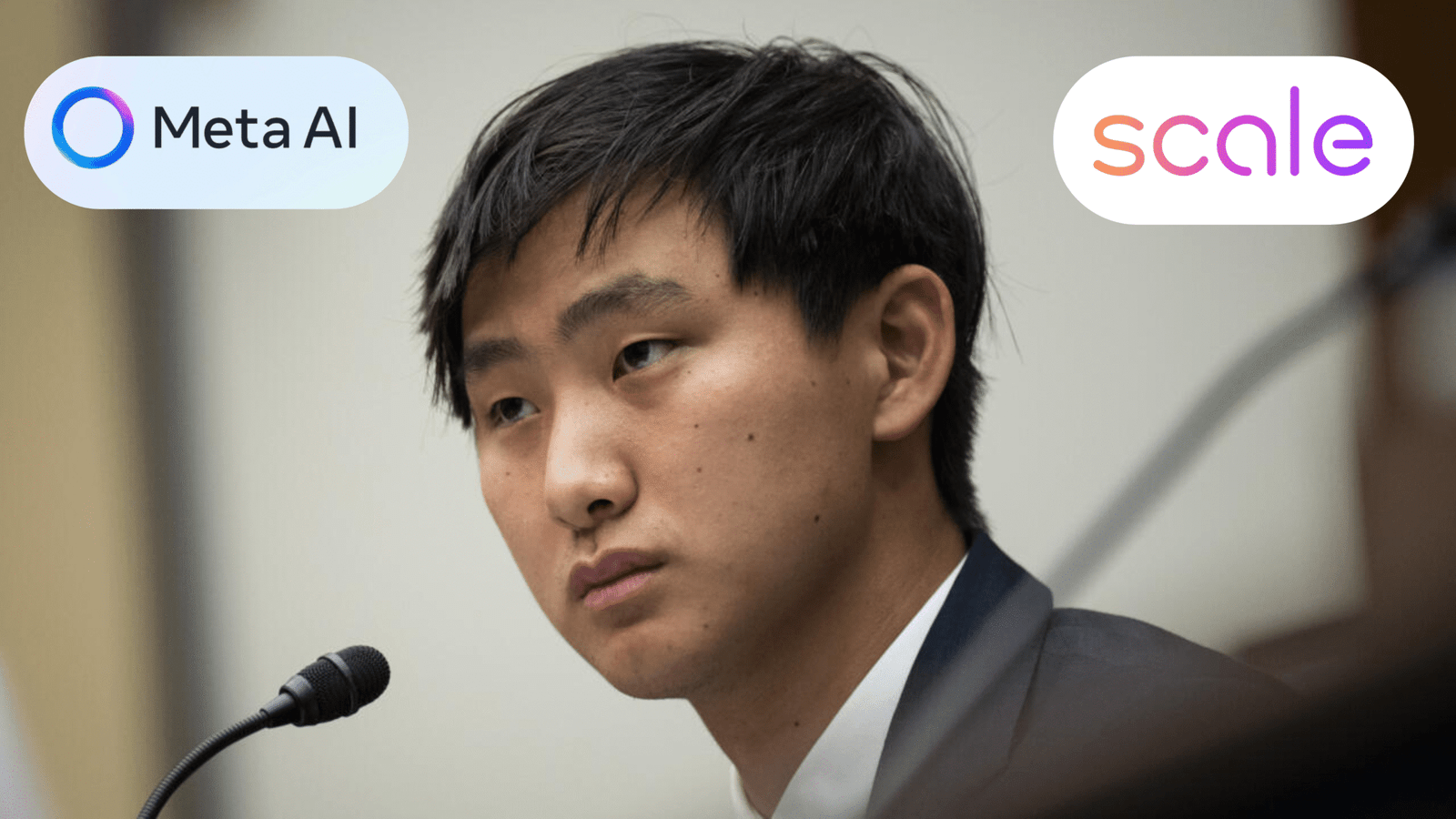

Meta’s $14–15 billion investment for a 49% stake in Scale AI—and the appointment of Scale CEO Alexandr Wang to lead a new “Superintelligence” division—suggests a strategic shift. It’s no longer just about developing open-source models like LLaMA. Meta is now investing in total control over the data pipelines needed to compete with frontier labs like OpenAI, Google DeepMind, and Anthropic.

This move provides Meta with access to one of the most important elements in modern AI development: not just the compute or the models, but the rarest commodity—structured, accurate, high-context data.

A Rival’s Rise: What the Market Is Saying

Following the Meta deal, several major AI labs reportedly began pulling away from Scale AI due to potential conflicts of interest. This has opened the door for rivals offering similar services, but with greater independence. One such company—left unnamed for now due to confidentiality agreements—has reportedly seen explosive demand from former Scale clients, including top teams from Microsoft and Anthropic.

This rival’s success reflects two broader industry concerns:

- Vendor neutrality matters. AI companies do not want their proprietary work to sit on infrastructure owned in part by a competitor.

- Trust in data management is now strategic. With the future of AI hinging on specialized datasets (medical, defense, enterprise), the companies handling this data become deeply embedded in the competitive dynamics of the industry.

The Data Bottleneck

The industry is entering what many call the “data bottleneck phase.” In the early 2020s, large language models trained on internet-scale datasets could reach near-human capabilities in general tasks. But training next-generation models demands increasingly domain-specific, private, and ethically-sourced datasets.

This is where companies like Scale—and its competitors—become indispensable. They not only label and structure data but also validate, test, and fine-tune model behavior. This makes them central to both commercial innovation and government AI strategy.

Meta’s Risk and Opportunity

For Meta, this partnership is a high-stakes effort to secure a leading position in the future of AI infrastructure. But the risks are real:

- Loss of external clients: Some analysts speculate that Scale AI could lose 30–40% of its non-Meta business over the next 12 months.

- Increased regulatory scrutiny: A growing number of policymakers are watching deals that consolidate too much power across data, compute, and talent pipelines.

- Backlash from open-source advocates: Meta’s past strategy hinged on community-led model development. This move could signal a drift away from openness.

Yet, the opportunity is equally significant. Owning a near-majority stake in one of the most critical data infrastructure companies could give Meta a long-term edge in training its own frontier models—on its own terms, at its own pace, and with significantly lower marginal costs.

Conclusion: A Realignment in the AI Supply Chain

The Meta-Scale AI deal—and the sudden success of its rivals—mark a clear shift in the AI economy. While most attention has been focused on models and chips, it is now the “data layer” that determines strategic advantage.

Companies that can guarantee secure, scalable, and high-integrity data handling will define the next chapter in AI. Meta’s investment is an admission of this reality—and the competition’s rapid response shows how quickly the AI supply chain is being redrawn.

This isn’t just about one deal. It’s about who owns the rails that the next wave of intelligence will run on.

Français

Français

English

English